On the eve of a five-week trial scheduled to start on February 3, 2020, Cheniere Energy, Inc. dismissed with prejudice all its claims against its founder and former CEO, Charif Souki. Cheniere had sued Mr. Souki for alleged tortious interference, breach of fiduciary duties, and facilitating fraudulent transfers relating to LNG projects that Cheniere had decided to abandon at the insistence of Wall Street investor Carl Icahn. The dismissal was a complete vindication for Mr. Souki and his new company, Tellurian Inc.

On the eve of a five-week trial scheduled to start on February 3, 2020, Cheniere Energy, Inc. dismissed with prejudice all its claims against its founder and former CEO, Charif Souki. Cheniere had sued Mr. Souki for alleged tortious interference, breach of fiduciary duties, and facilitating fraudulent transfers relating to LNG projects that Cheniere had decided to abandon at the insistence of Wall Street investor Carl Icahn. The dismissal was a complete vindication for Mr. Souki and his new company, Tellurian Inc.

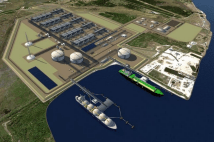

The case had been ongoing for years. Parallax, a company controlled by former British Gas executive Martin Houston, had been developing two LNG facilities for Cheniere in 2015. Later in 2015, after Parallax and Cheniere had entered into their joint development agreement for the two facilities, activist investor Carl Icahn acquired a sizable stake in Cheniere stock and was allowed to appoint two directors to Cheniere’s Board. In December 2015, Icahn’s appointees arranged for the Board to abandon the Parallax projects and to fire Mr. Souki.

Parallax sued Cheniere in 2017, alleging that Cheniere wrongfully backed out of their agreement to pay Parallax $200 million for each of the two LNG facilities. Cheniere responded by suing Parallax and several third parties, including Souki’s new company, Tellurian. Cheniere alleged that it had loaned Parallax $46 million to develop the LNG facilities and that Parallax was unable to pay Cheniere back because Tellurian and several individuals had fraudulently transferred Parallax’s business opportunity to Tellurian.

Cheniere did not sue Mr. Souki, however, until nearly two years later – and only weeks before he was scheduled to be deposed in the original case. In addition to the same tortious interference and fraudulent transfer claims it had brought against the other third parties, Cheniere alleged that if Mr. Souki had made the $400 million agreement with Parallax, doing so exceeded his authority and was, therefore, a breach of his fiduciary duties to Cheniere. Cheniere further alleged – in contravention to established Delaware law – that Mr. Souki’s preparations to compete while he was still a Cheniere Board member also constituted breaches of his fiduciary duties.

Heading into trial, Yetter Coleman had won a motion to designate the other 2015 Cheniere Board Members as responsible third parties on the theory that if Cheniere had been harmed, that harm was the result of Cheniere’s Board members’ rash decision to abandon the Parallax projects without analysis or due diligence. Yetter Coleman also won motions to strike Cheniere’s legal experts (a former Delaware Judge and a Harvard Law Professor) on fiduciary duty law, while preserving Souki’s right to call an industry expert on corporate governance and customary board practices. Finally, working side-by-side with Tellurian’s counsel (led by Jim Wetwiska at Akin Gump), Yetter Coleman secured a summary judgment on a key component of Cheniere’s tortious interference claim. With these rulings, Souki’s defense was well-positioned for trial, which ultimately turned out to be unnecessary.

Our trial team includes Paul Yetter, Tim McConn, Autry Ross, Doug Griffith, Emma Perry, and Amy Farish, and our appellate preparations were led by Reagan Simpson and Dori Kornfeld Goldman. The case is cause no. 2017-49685, consolidated with no. 2019-11559, Parallax Enterprises LLC v. Cheniere Energy, Inc. v. Martin Houston, et. al.